Tired Of Hearing Late Payment Excuses from Customers?

Are you tired of hearing late payment excuses from customers? Sadly, many firms and individuals who are owed money get used to receiving explanations and apologies for delayed payments. It can be extremely frustrating to deal with customers who don’t pay on time, especially when you’ve done everything you can to accommodate them. In this […]

Court Proceedings for Debt Claims: Dos, Don’ts, and Delays

If you’re owed money, it’s important to take the necessary steps to get the debt repaid. This can often include issuing court proceedings for debt claims to recover the money owed. However, there are a number of things you need to bear in mind before taking this step. In this blog post, we’ll discuss some […]

In-House Or Outsourced Credit Control?

There are two main ways to handle credit control in your business: in-house or outsourced. Both have their own pros and cons, and it can be difficult to decide which is the best option for your company. In this blog post, we will outline what in-house and outsourced credit control are, and discuss the pros […]

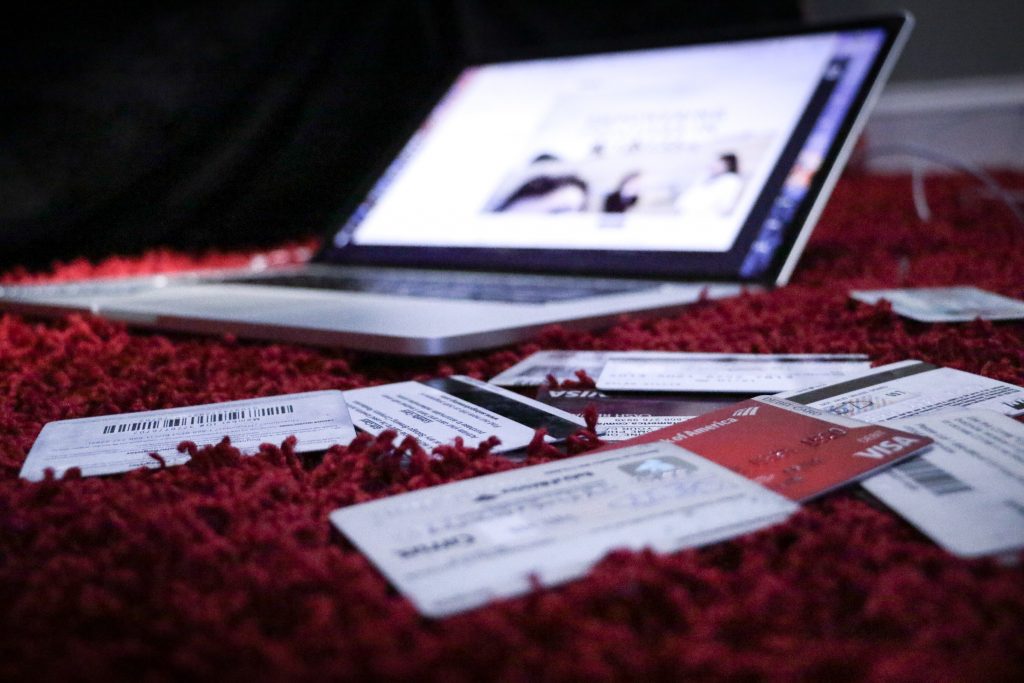

4 Top Debt Collection Myths Debunked

There are a lot of myths and misconceptions about debt collection. Some people believe that debt collectors are sharks who will do anything to get their hands on money owed. Others think that debt collectors are always fair and reasonable, and will work with you to come up with a repayment plan. The truth is, […]

How to Invoice Properly | Business Credit Control Tips

Invoicing is an essential part of any business, yet it can be tricky to get right. Invoice properly and you could see a dramatic increase in your cash flow; invoice improperly and you could find yourself out of pocket with little to show for it! In this blog post, we’ll look at why invoicing is […]

Commercial Debt Recovery | Why Ceasing To Supply Bad Paying Customers Makes Business Sense

Every business will have customers within their commercial debt recovery process who are difficult to deal with. They might be slow to pay, or they may demand discounts for no reason. When these customers become a drain on your resources, it can make sense to stop supplying them altogether. When should I cease to supply […]

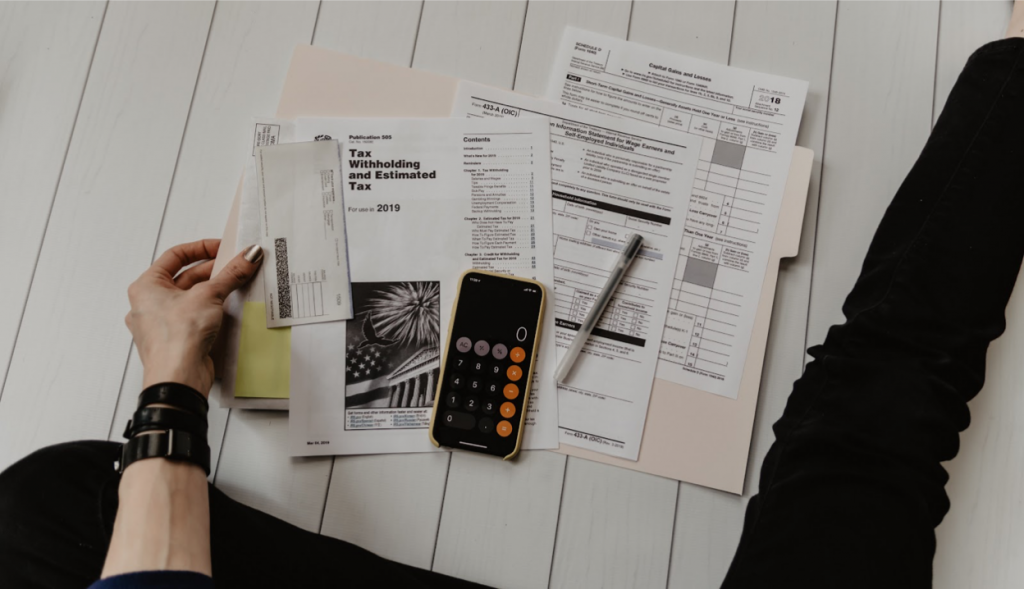

How To Charge Interest On Late Payments

Charging interest on late payments is a legal way to recover compensation on money that is owed to you. When a customer pays their debt late, they are essentially borrowing money from you. Businesses can earn back some of the money that they have lost due to late payments. In this blog post, we will […]

Interest Rate Rise Could Help SMEs Tackle Late Payments

The Bank of England’s decision to increase the interest rate could be good news for SMEs tackle late payments. The higher rate will make it more expensive for companies to delay settling their debts, and may encourage them to pay up sooner. This could be a welcome relief for SMEs who are often struggling to […]

What To Do When An Invoice Exceeds Terms

Chasing overdue invoice payments can be a hassle. Not only do you have to make sure that you collect invoices on time, but you also need to be aware of any late payment penalties or interest charges that might apply. If an invoice payment exceeds the terms of the invoice, what should you do? Not […]

3 Key Considerations To Improve Your Credit Control Process

Running a successful business is all about cash flow. You need to make sure you have enough money coming in to cover your expenses, and that includes debt repayments. One of the most important aspects of cash flow is credit control. If you don’t have a good credit control process in place, you could find […]